Some businesses are reticent to use asset finance due to concerns that they may potentially pay more than the initial cost of the equipment or asset over the long-term.

There is no argument that with some asset finance products, it’s possible that by continuing to rent or lease beyond the initial useful life of an asset, or where the financier is not transparent with end-of-term options and processes, that a business will pay significantly more than the original cost of the asset. In these situations, it's vital that a business works closely with their financier to ensure they are selecting the right product and that the business understands how the product features operate in theory and in reality.

When it comes to asset finance, one key area that is often overlooked by organisations, is its ability to enable a business to invest its capital where it matters most...its people.

The following is an example of how asset finance can help your business recruit and retain your employees:

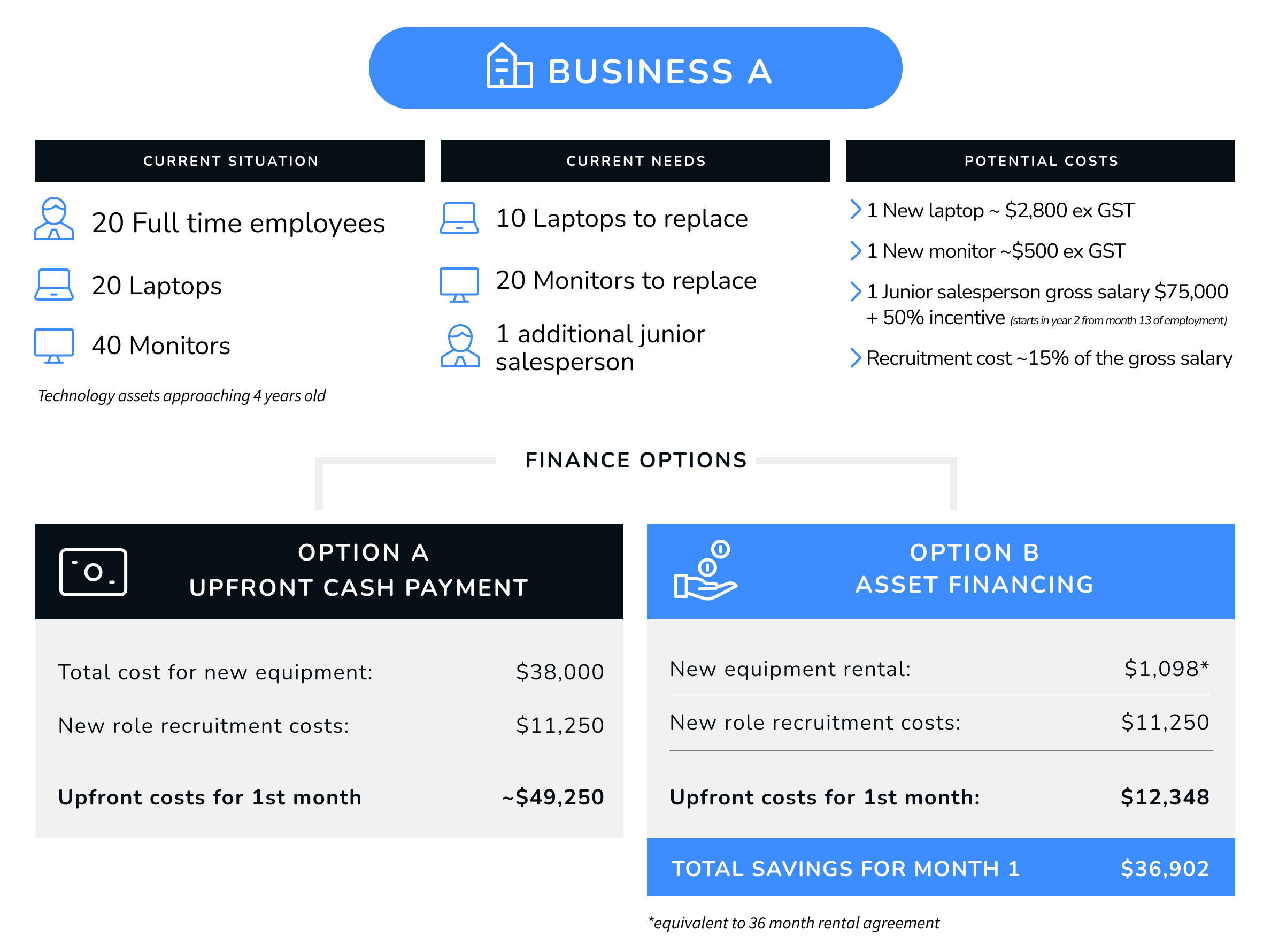

Let’s assume business A has a team of 20 FTE’s. Business A has in the past purchased their technology, which includes a laptop and two monitors for each employee. Unfortunately, the equipment is now approaching 4 years of age and the performance of some of the laptops is degrading, whilst the resolution of some of the monitors is now underperforming. A total of 10 laptops and 20 new monitors have been identified as requiring replacement in the current refresh, with the remain 10 laptops and 20 monitors to be replaced in 12 months-time.

Business A is also going through a growth phase and has identified that they need an additional junior customer salesperson, who they want to invest and train over the next 12 months to take on their own customer portfolio.

1 new laptop ~ $2,800 ex GST

1 new monitor ~$500 ex GST

1 junior customer salesperson gross salary $75,000 + 50% incentive, which starts in year 2 (from month 13 of employment contract)

Recruitment cost ~15% of the gross salary

Business A has traditionally paid cash, but are now exploring the concept of asset finance to fund the acquisition of the 10 new laptops and 20 new monitors. One of the reasons for considering asset finance now, is that they also want to bring onboard the new employee asap, as they are looking to accelerate their sales revenue.

If Business A pays upfront for the new equipment, they will incur a total cost of $38,000.

If Business A recruits the new role within the first month of advertising (coinciding with the technology refresh), they will incur an upfront cost of $11,250.

This means in month 1, Business A is potentially incurring a total cost of ~$49,250.

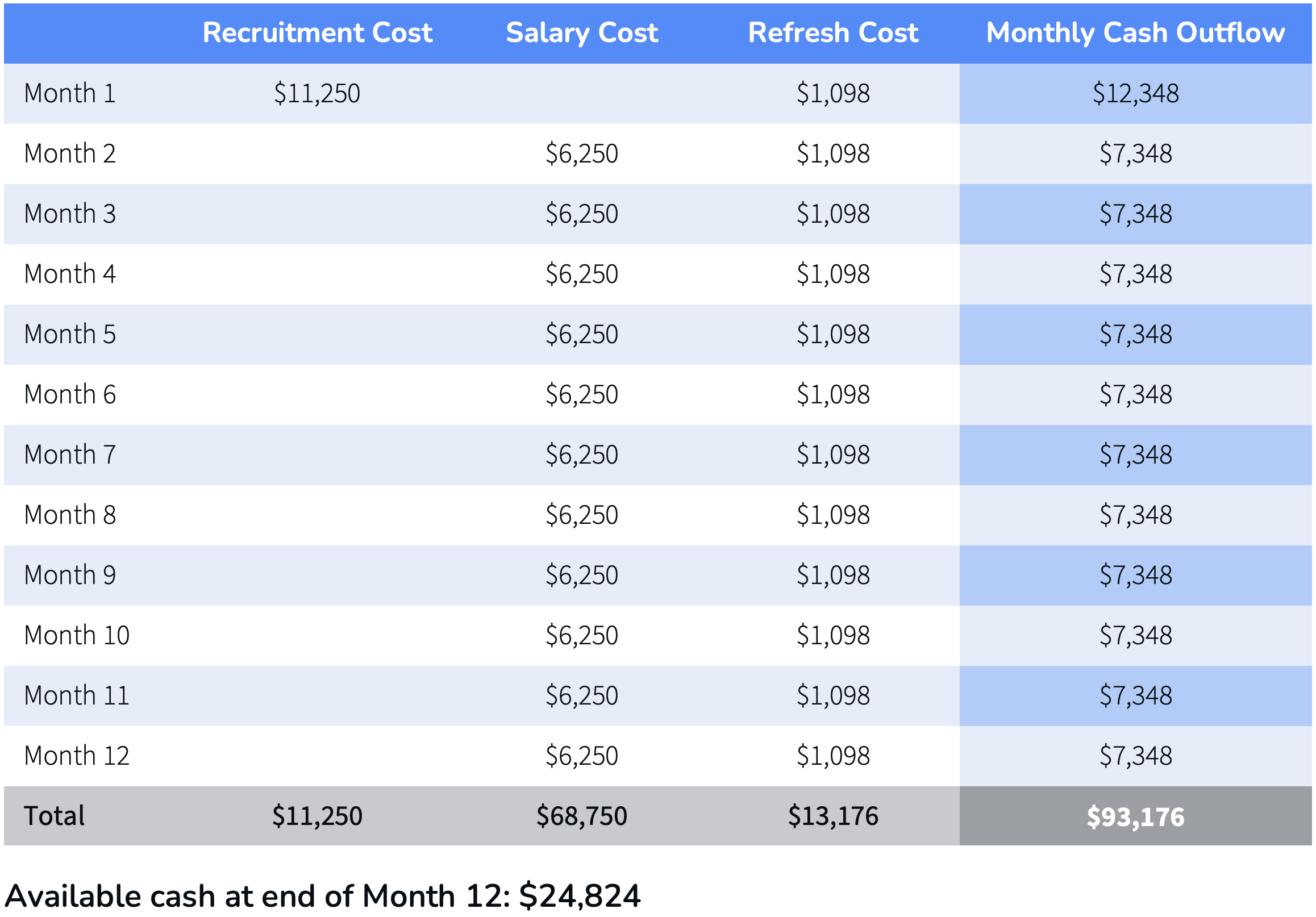

Assuming Business A went with asset financing for the technology refresh, its first month cost would have been $12,348 (recruitment cost of $11,250 and rental cost of laptop refresh of $1,098*). This is a month 1 saving of $36,902. Why is this important? In month 2, when Business A needs to start paying its new employee their first months’ salary (1/12 of $75,000), it has the extra capital to do so. If the business is also successful in bringing onboard the new salesperson, and after the first 12 months of performance, decide to bring on another salesperson, they still have $24,824 from their initial cash flow timing difference, to invest in a new recruitment process.

Not only has Business A, managed to retain cash in the business, they are also able to redeploy this cash to invest in people, which for most businesses, is their most valuable asset.

There are several other additional benefits for Business A, including:

*equivalent to 36 month rental agreement

For more information get your copy of the Amicus Small Business Finance Guide by clicking the link below.

Sydney

Level 10, 2-4 Bulletin Place

Sydney NSW 2000

Phone: 1300 360 877

Melbourne

Level 2, 517 Flinders Lane

Melbourne VIC 3000

Phone: 1300 360 877

Brisbane

Level 8, 344 Queen Street

Brisbane QLD 4000

Phone: 1300 360 877

Amicus QLD Contracting Pty Ltd

QBCC Licence No: 15240138